Insights The things we’re thinking and doing

Filter insights by

-

-

Building a brand from within: The impact of culture in marketing

-

Meet Ben, our new Escapee!

-

The trust factor: How to build credibility & loyalty through customer-centric marketing

-

Defining buyer personas: where to begin

-

Meet Jack, our new Escapee!

-

Embracing your brand reputation

-

The state of B2B content marketing in 2025

-

Changing trends: how to benefit from trend-based marketing

-

Are brands losing their personality?

-

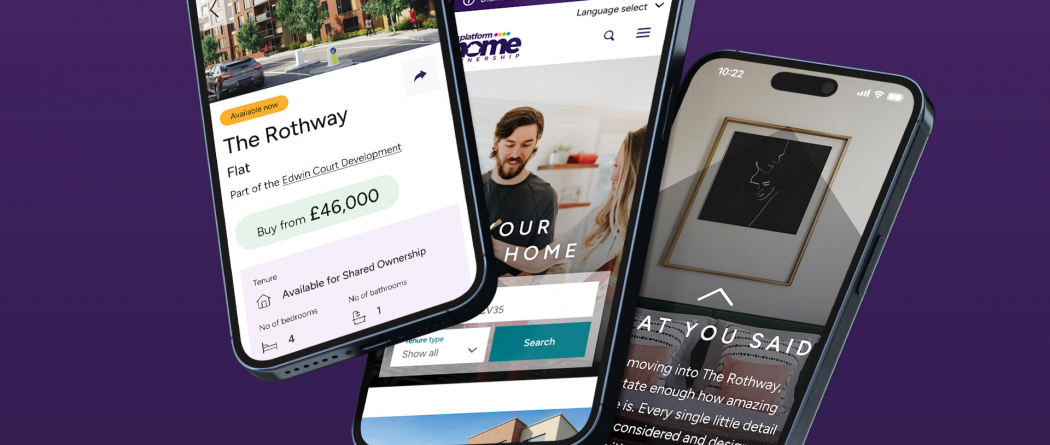

Building a community in the property sector

-

Have you outgrown your website?